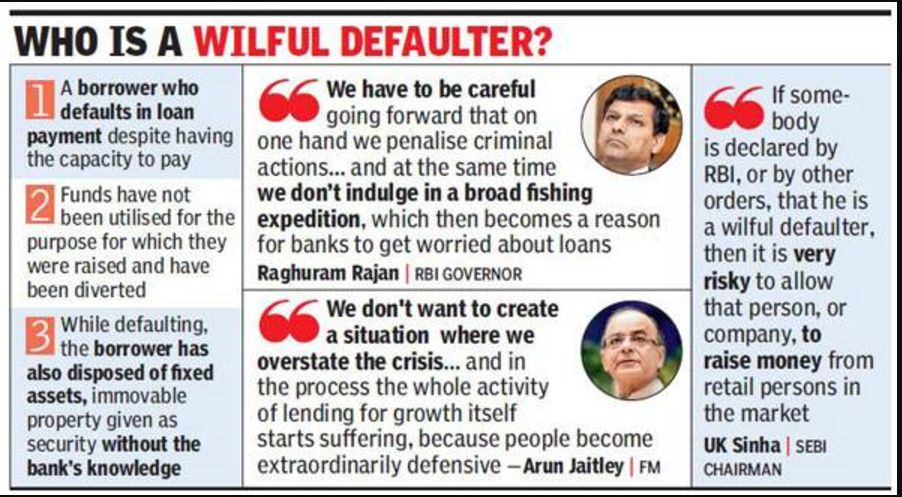

What is the time limit for willful defaulter ?

The FAQs issued by the RBI state that borrowers classified as fraud or wilful defaulters cannot borrow fresh funds from lenders even after the cooling period of 12 months. The FAQs reference every RBI circular that has allowed settlement with wilful defaulters.

Can wilful defaulters go for compromise settlement ?

Fresh loans under compromise settlement only after 12 months. Wilful defaulters and companies involved in fraud can go for a compromise settlement or technical write-offs by banks and finance companies, as per a circular by Reserve Bank of India (RBI).

RBI Guidelines

RBI had advised IBA vide letter dated May 10, 2007 that, “(i) banks may enter into compromise settlement with wilful defaulters/ fraudulent borrowers without prejudice to the criminal proceeding underway against such borrowers; (ii) All such cases of compromise settlements should be vetted by Management Committee/Board of Banks. (Circular dated June 8, 2023 on ‘Framework for Compromise Settlements and Technical Write-offs’)

What is the punishment for wilful defaulter in India ?

SARFAESI Act of 2002: It was revised to include a three-month sentence if a borrower fails to furnish asset information and the lender does not obtain control of the mortgaged property within 30 days.

Will a loan defaulter not go to jail ?

Criminal charges cannot be put on a person for loan default. It means, the police just cannot make arrests. Hence, a genuine person, unable to pay back the EMI, must not become hopeless. There are rules which will help the defaulter to negotiate with his/her lender.

Can civil court try suit filed by borrower against bank?

The Supreme Court held that a Civil Court has jurisdiction to try a suit filed by a borrower against a Bank or Financial Institution.

CIVIL APPEAL NOS.8972-8973 OF 2014; November 10, 2022

BANK OF RAJASTHAN LTD. versus VCK SHARES & STOCK BROKING SERVICES LTD

How do I remove my name from Wilful defaulters list ?

You will have to obtain a No-Objection Certificate (NOC) from your bank post the payment of your dues in order to get your name removed from the defaulters list. How many years will CIBIL keep record of defaulters? CIBIL keeps the record of a defaulter for 7 years.

What are the rights of loan defaulters ?

Despite defaulting on a loan, borrowers have various rights, including the right to privacy, the right to be heard and the right to adequate notice. If the reason for EMI default is genuine, you have some leeway.